The COVID-19 pandemic has spread with alarming speed, infecting millions and bringing economic activity to a near-standstill as countries imposed tight restrictions on movement to halt the spread of the virus. As the health and human toll grows, the economic damage is already evident and represents the largest economic shock the world has experienced in decades. The June 2020 Global Economic Prospects describes both the immediate and near-term outlook for the impact of the pandemic and the long-term damage it has dealt to prospects for growth. The baseline forecast envisions a 5.2 percent contraction in global GDP in 2020, using market exchange rate weights—the deepest global recession in decades, despite the extraordinary efforts of governments to counter the downturn with fiscal and monetary policy support. Over the longer horizon, the deep recessions triggered by the pandemic are expected to leave lasting scars through lower investment, an erosion of human capital through lost work and schooling, and fragmentation of global trade and supply linkages.

The pandemic is expected to plunge most countries into recession in 2020, with per capita income contracting in the largest fraction of countries globally since 1870. Advanced economies are projected to shrink 7 percent. That weakness will spill over to the outlook for emerging market and developing economies, who are forecast to contract by 2.5 percent as they cope with their own domestic outbreaks of the virus. This would represent the weakest showing by this group of economies in at least sixty years.

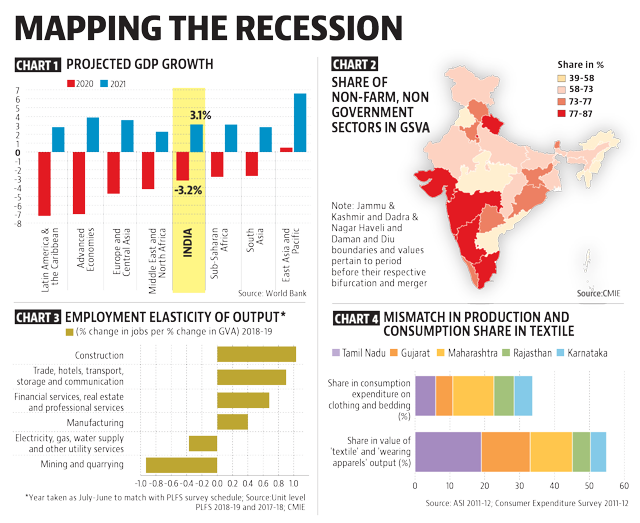

Every region is subject to substantial growth downgrades. East Asia and the Pacific will grow by a scant 0.5%. South Asia will contract by 2.7%, Sub-Saharan Africa by 2.8%, Middle East and North Africa by 4.2%, Europe and Central Asia by 4.7%, and Latin America by 7.2%. These downturns are expected to reverse years of progress toward development goals and tip tens of millions of people back into extreme poverty.

Emerging market and developing economies will be buffeted by economic headwinds from multiple quarters: pressure on weak health care systems, loss of trade and tourism, dwindling remittances, subdued capital flows, and tight financial conditions amid mounting debt. Exporters of energy or industrial commodities will be particularly hard hit. The pandemic and efforts to contain it have triggered an unprecedented collapse in oil demand and a crash in oil prices. Demand for metals and transport-related commodities such as rubber and platinum used for vehicle parts has also tumbled. While agriculture markets are well supplied globally, trade restrictions and supply chain disruptions could yet raise food security issues in some places.

IMPACT ON INDIAN ECONOMY

ILO said that pandemic is not only the world Health crisis rather it is also a Labour Market and Economic Crisis. There is also an emergence of fall in GDP 90% of countries request financial help to International monetary Fund. According to ILO 2.5 crores of employment are brought in under a situation of decline. Government regulate many programmes and activities like Social Distancing, Lockdown, Sanitisation, mask protection, Quarantine etc but still doesn’t found a correction. Lockdown mostly affects the informal area and it leads to 50% of our economic GDP. Raw materials don’t be purchased and goods out not explore in the markers and causes big unemployment.

As per the official data released by the ministry of statistics and program implementation, the Indian economy contracted by 7.3% in the April-June quarter of this fiscal year. This is the worst decline ever observed since the ministry had started compiling GDP stats quarterly in 1996. In 2020, an estimated 10 million migrant workers returned to their native places after the imposition of the lockdown. But what was surprising was the fact that neither the state government nor the central government had any data regarding the migrant workers who lost their jobs and their lives during the lockdown.

The second wave of Covid-19 has brutally exposed and worsened existing vulnerabilities in the Indian economy. India’s $2.9 trillion economy remains shuttered during the lockdown period, except for some essential services and activities. As shops, eateries, factories, transport services, business establishments were shuttered, the lockdown had a devastating impact on slowing down the economy. The informal sectors of the economy have been worst hit by the global epidemic. India’s GDP contraction during April-June could well be above 8% if the informal sectors are considered. Private consumption and investments are the two biggest engines of India’s economic growth. All the major sectors of the economy were badly hit except agriculture. The Indian economy was facing headwinds much before the arrival of the second wave. Coupled with the humanitarian crisis and silent treatment of the government, the covid-19 has exposed and worsened existing inequalities in the Indian economy. The contraction of the economy would continue in the next 4 quarters and a recession is inevitable. Everyone agrees that the Indian economy is heading for its full-year contraction. The surveys conducted by the Centre For Monitoring Indian Economy shows a steep rise in unemployment rates, in the range of 7.9% to 12% during the April-June quarter of 2021. The economy is having a knock-on effect with MSMEs shutting their businesses. Millions of jobs have been lost permanently and have dampened consumption. The government should be ready to spend billions of dollars to fight the health crisis and fast-track the economic recovery from the covid-19 instigated recession. The most effective way out of this emergency is that the government should inject billions of dollars into the economy.

The GDP growth had crashed 23.9% in response to the centre’s no notice lockdown. India’s GDP shrank 7.3% in 2020-21. This was the worst performance of the Indian economy in any year since independence. As of now, India’s GDP growth rate is likely to be below 10 per cent.

0 Comments